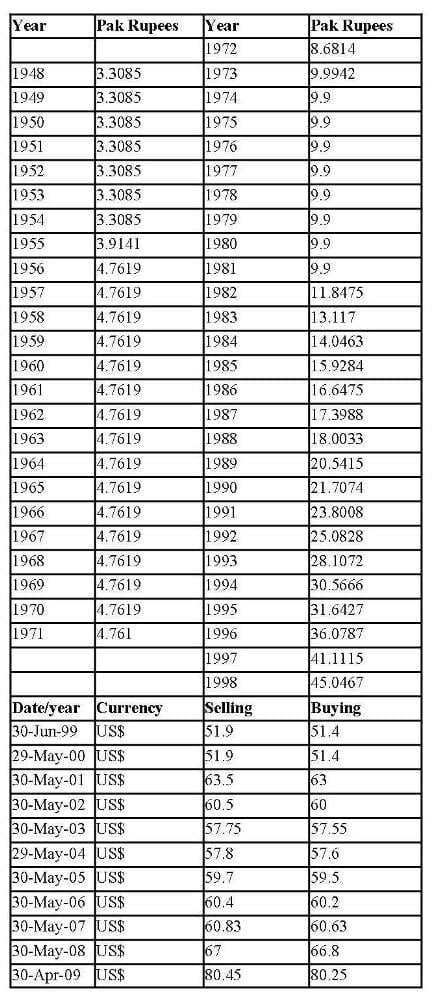

dollars is based on the date the foreign currency is converted to U.S. tax payments in a foreign currency, the exchange rate used by the IRS to convert the foreign currency into U.S. Note: The exchange rates referenced on this page do not apply when making payments of U.S. Below are government and external resources that provide currency exchange rates. Todays market rate for common transfer amounts USD to INR. That means you get a more expensive exchange rate. Banks and money transfer providers use this rate to exchange foreign currencies between themselves, but add hidden fees to the rates they give their customers. Currency Exchange RatesĪn exchange rate is the rate at which one currency may be converted into another, also called rate of exchange of foreign exchange rate or currency exchange rate. This means weve seen an increase of 12.2 (0.15) over the past month. There’s only one true exchange rate the mid-market rate.

dollars to report on your income tax return. At the end of the year, translate the results, such as income or loss, into U.S. USD to INR FORECAST for tomorrow, this week and month. More details on current USD to INR below. Home Currency Calculator Graphs Rates Table Monthly Average.

Dollar rupee exchange rate free#

Select your currencies and the date to get histroical rate tables. Analyze historical currency charts or live Indian rupee / US dollar rates and get free rate alerts directly to your email. dollar, make all income tax determinations in your functional currency. Get historic exchange rates for past US Dollar foreign expenses. If your functional currency is not the U.S. You can generally get exchange rates from banks and U.S. Current USD to INR exchange rate equals 82.0720 Rupees per 1 US Dollar. If there is more than one exchange rate, use the one that most properly reflects your income. Use the exchange rate prevailing when you receive, pay, or accrue the item. (including taxes), that you receive, pay, or accrue in a foreign currency and that will affect computation of your income tax. dollar, you must immediately translate into dollars all items of income, expense, etc. Make all income tax determinations in your functional currency. The business books and records are not kept in the currency of the economic environment in which a significant part of the business activities is conducted.

0 kommentar(er)

0 kommentar(er)